BY: SAMANTHA BARTLETT, DVM

The Veterinary Debt Initiative (VDI) is a joint effort from the American Veterinary Medical Association (AVMA), American Association of Veterinary Medical Colleges (AAVMC) and the Veterinary Medical Association Executives (VMAE) to collaborate on reducing the veterinary student debt load. The VDI has a multi-faceted approach to veterinary student loan debt. The VDI strategic plan works to provide resources to help veterinary students and professionals make the best financial decisions regarding student loan debt. The four-year strategic plan involves several stages of planning and implementing including developing guidelines for mentoring, guidance for employers on developing loan assistance programs, and guidance for different career stages.

Some of the programs already in place as a result of the VDI include the AVMA’s My Veterinary Life website (https://myvetlife.avma.org/) designed to help veterinary students and recent graduates navigate the process of student loan repayment and financial strategies to help manage that debt. The My Veterinary Life website has a set of links devoted to financial health that include salary calculators, personal financial planning, money management, and loan repayment strategies. The AAVMC has developed materials to illustrate the full cost of veterinary school attendance targeting pre-veterinary students considering the career field. AAVMC also offers a tool comparing the cost of tuition among national and international veterinary schools. The website for the VMAE (https://vmae.org/resources/financial-literacy/) provides tools and resources for financial literacy. The VDI website (https://www.aavmc.org/additional-pages/veterinary-debt-initiative) focuses on news updates and best practices.

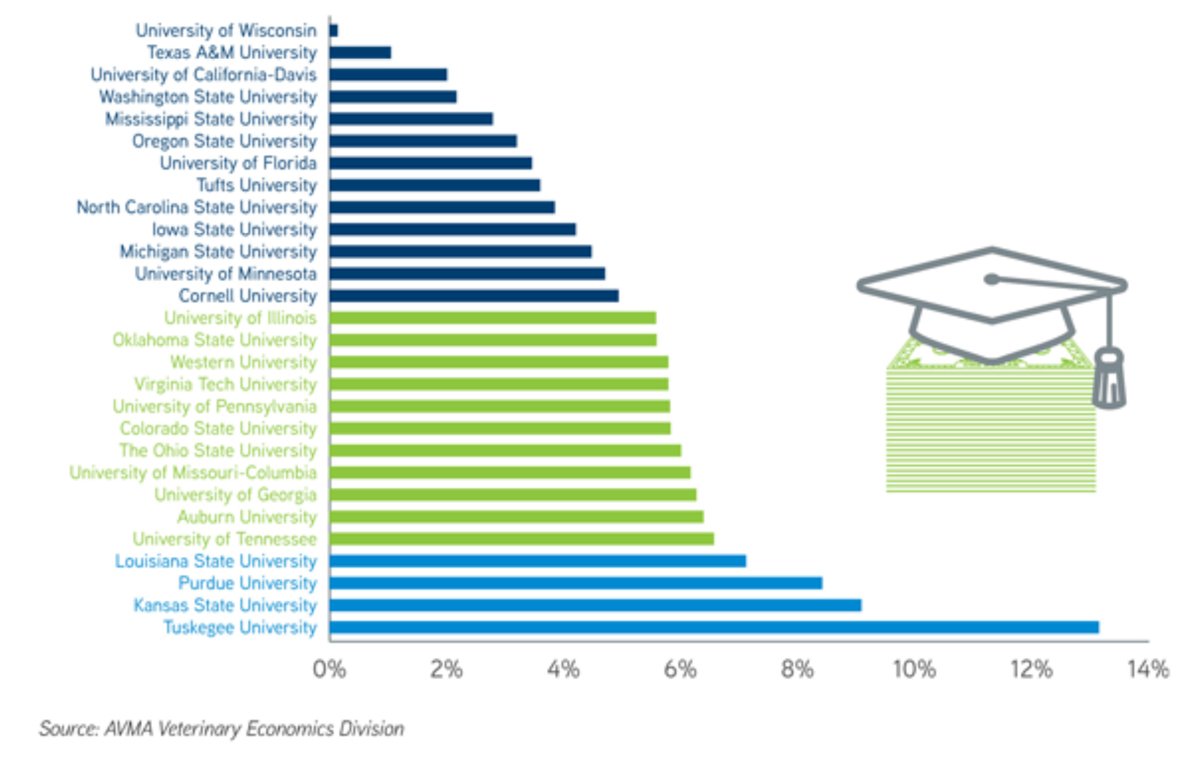

Annual student debt averages about a 7% increase per year. In 2018, the mean veterinary educational debt was $183,000. The VDI held a collaborative session at the AVMA leadership conference in Chicago this past January. One of the topics was focusing on the schools whose students graduated with lower than average debt and using those strategies to impliemnt a lower student debt load in other schools across the country. The VDI is also advocating in the federal legislature to ensure the needs of the veterinary profession are represented in the Higher Education Act, as well as to ensure the continued funding of federal loan programs and student loan forgiveness programs.

Dr. Andrew Maccabe, CEO of AAVMC suggests that we change the focus of financial education toward more targeted subjects such as practice ownership. Last summer, the AVMA House of Delegates charged the AVMA with tasks targeted toward supporting students and recent grads with financial advisors to help them manage debt loads, developing a low interest loan program, empowering state VMAs to seek increased funding for educational loans and repayment programs and helping employers to assist recent graduates with student loan debt.

The Council on Education (COE) the accrediting body of veterinary medical schools recently updated accreditation standards to include addressing financial education and advocacy. These new standards require schools to provide counseling and education on financial aid, career advisement and debt management. In addition, schools are required to inform students on procedures for withdrawal and tuition refunds.

MEAN ANNUAL CHANGE IN DEBT OF RESIDENT GRADUATES SINCE 2006